Liability Insurance: What It Is And Why You Need It

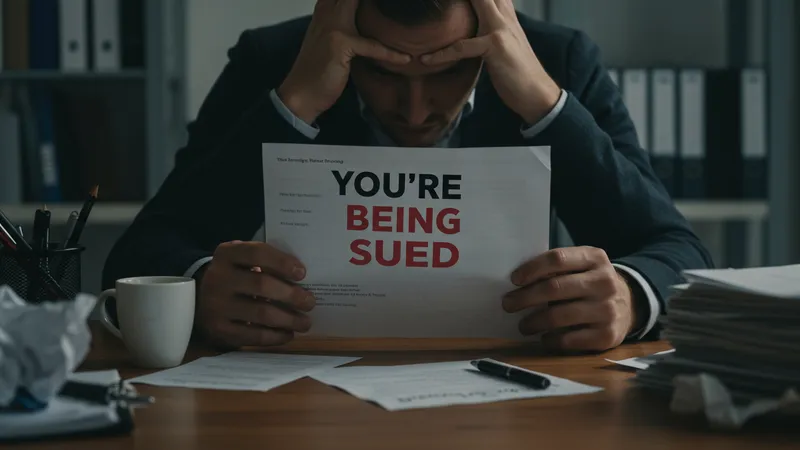

Imagine you’re sipping coffee at your desk when you receive a letter that changes everything: you’re being sued. Without liability insurance, this could mean financial ruin.

In today’s litigation-prone society, liability insurance is more critical than ever. Can you afford to leave your assets vulnerable?

- Nationwide: Extensive liability coverage options with premium add-ons. Learn more, starting at $25/month.

- GEICO: Innovative digital claims process. Discover GEICO, with plans beginning at $29/month.

The stunning truth is, most people don’t know just how vulnerable they are without proper liability insurance. You might think your assets and lifestyle are protected, but you might be wrong. Recent reports show that lawsuits are more common than ever, with settlements soaring into millions. But that’s not even the wildest part…

What if I told you that even those with existing insurance might not be fully covered due to common policy misunderstandings? That’s right, hidden clauses and exemptions can leave you high and dry in a lawsuit. This misconception has caught even seasoned experts off guard. But the surprises don’t stop here…

You might think securing appropriate liability insurance is simply about choosing the right plan, but the rabbit hole goes much deeper. What happens next shocked even the experts…