Car Insurance In USA: Everything You Need To Know In 2025

Trends, Innovations, and the Future of Car Insurance in the USA

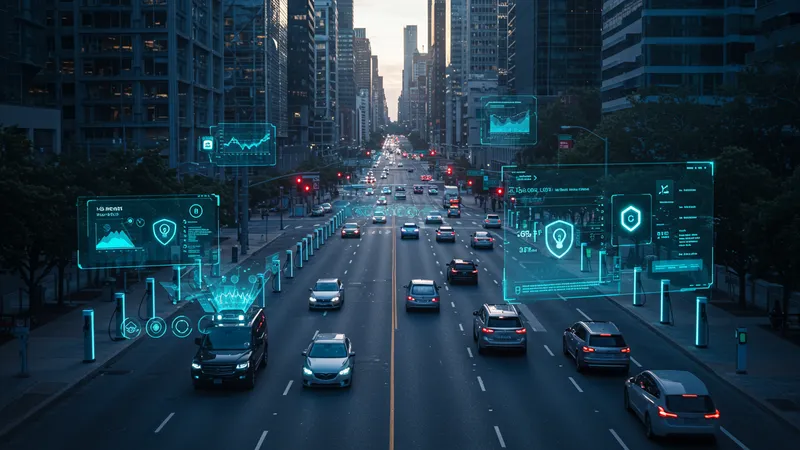

2025 marks a turning point for car insurance in the USA, as industry innovation accelerates and consumer expectations evolve. Usage-based insurance (UBI) continues to expand, giving drivers control over their premiums based on actual driving patterns. This shift rewards safe habits while encouraging widespread adoption of telematics—potentially leading to safer roads nationwide.

Electric and autonomous vehicles are changing risk profiles and prompting new coverage categories. Insurers are developing specialized products for EVs, addressing concerns like battery replacement, charging station incidents, and software vulnerabilities. As partial automation becomes more common, policies adapt to include cyber protection and expanded liability options unique to self-driving technology.

Insurtech start-ups add fresh competition, introducing innovative business models such as on-demand and pay-per-mile insurance. These flexible solutions are particularly attractive to urban residents or those who drive sporadically. The trend toward transparency and personalized experiences is challenging established providers and reshaping how Americans approach vehicle protection.

Environmental and regulatory changes, from climate risks to evolving state mandates, also influence future directions. Providers are investing in analytics to anticipate storm surge, wildfire, and other catastrophe exposures—enabling more precise risk management and quicker settlements. The dynamic landscape ensures car insurance in the USA will continue to adapt, securing drivers in a rapidly changing world.