Choosing The Best Car Insurance Policy For British Drivers

The Real Impact of Location on Your Premium

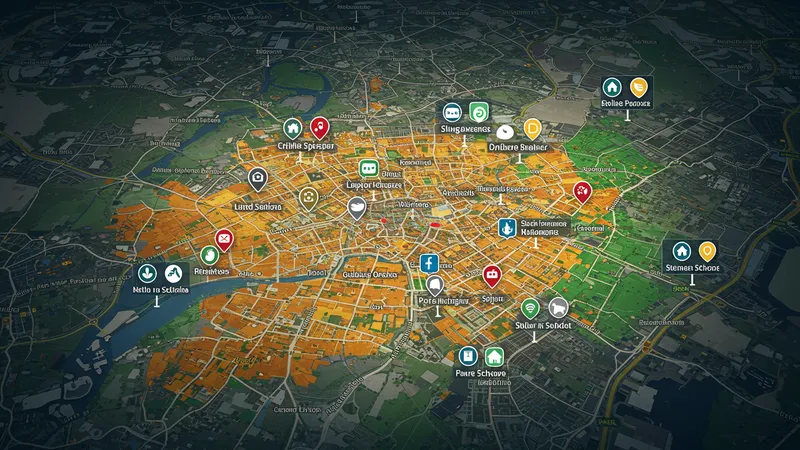

Did you know that your postcode could be one of the biggest factors affecting your insurance premium in the UK? Insurers often rely on data-driven models that covertly factor in location when calculating quotes. Areas with higher crime rates, traffic congestion, or even complex road layouts could result in a drastic increase in your costs. But that’s not the full story…

Not only does location affect the likelihood of theft or accidents, but it also reflects the insurer’s dataset encompassing crime prevalence, historical claims, and local traffic incident reports. While this might be understood at a surface level, there are deeper implications. For instance, living near a school might raise your premium due to the perceived risk of increased traffic. The real surprise, however, lies in how some suppliers prioritize data over your actual driving behavior.

A shocking insider tip reveals that some insurers track your movement to offer discounts based on your mobility patterns. Using telematics or ‘black box’ technology, they assess your driving habits, regardless of your postcode. A careful driver in a risky area could still pay less than a reckless driver in a low-risk zone. Here’s the kicker though: the implementation of this tech isn’t universal, and it’s crucial to know if your provider offers it.

Understanding these details could dramatically alter the perception of car insurance pricing. The next time you consider a policy change, step back and analyze how much emphasis your insurer places on location versus your driving habits. Uncovering these secrets could empower you to renegotiate better terms. Eager to learn more about actionable strategies to lower your premiums? The next discovery awaits…