Choosing The Best Car Insurance Policy For British Drivers

Why Comprehensive Isn’t Always Best

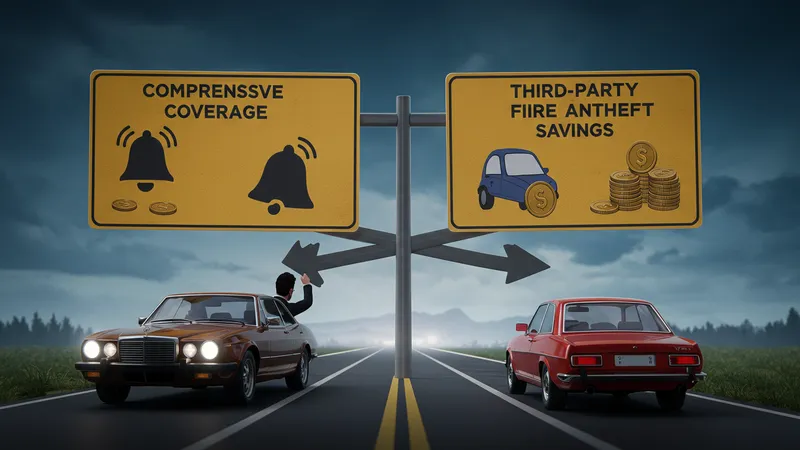

The term ‘comprehensive coverage’ creates an illusion of complete protection, misleading many drivers into opting for it without understanding its limitations. Comprehensive implies all-encompassing, yet it isn’t always the best or most cost-effective option for everyone. But here’s the catch: some drivers might actually save by opting for third-party, fire, and theft coverage instead. So how do you know what’s best?

Comprehensive policies often include various bells and whistles that might not be essential depending on individual circumstances. For instance, if your vehicle is of low market value, paying for repairs out of pocket might prove more economical than blasting cash on unnecessary features. However, opting for a lower level of coverage could mean sacrificing essential benefits like personal accident cover. Yet, there’s more to this evaluation…

Understanding the coverage trade-offs based on your specific driving habits and vehicle needs is crucial. It’s not just about saving a few pounds upfront; long-term savings and peace of mind hinge on aligning the policy with your lifestyle. Perhaps you’ve been drawn to comprehensive policies because of perceived peer pressure or marketing hype. The question remains: could you be tricked into paying more because of societal expectations?

Breaking free involves carefully evaluating what’s truly necessary. British drivers who conscientiously shift to a tailored policy often discover savings without major trade-offs in protection. Discovering this delicate balance could redefine how you value insurance protection in the broader scheme of financial planning. Eager to uncover more about these strategic decisions? Prepare for further disparagements of conventional insurance wisdom…