Choosing The Best Car Insurance Policy For British Drivers

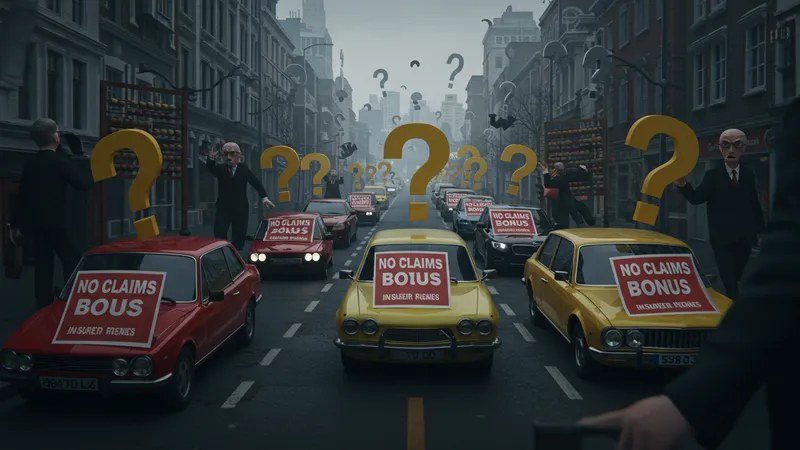

The Myth of No Claims Bonus

The allure of the No Claims Bonus (NCB) offers drivers the thrilling prospect of lower premiums year after year. But what’s often ignored is the fickleness of these bonuses—just a single claim could wipe out years of careful accumulation. What’s even more perplexing is that these bonuses may not always translate into real savings, depending on individual circumstances. Ready to uncover more?

Drivers are often misled into believing that maintaining a spotless record guarantees significant discounts, yet in reality, the NCB is usually capped. More astonishing, some providers might adjust the base premium upwards, diluting any perceived benefits. It’s a game that insurers have mastered, purportedly rewarding drivers while safeguarding their profitability.

There’s an undercurrent of tactics employed by insurers to keep NCB tales romanticized across marketing materials and contracts. Enquiring into the actual discount percentages and how they’re applied across different policies can unveil these truths. Could it be that clinging too tightly to maintaining an NCB is actually limiting your policy options? The reality might shake your confidence in these promises.

Savvy drivers recognize that while an NCB could undoubtedly be instrumental in negotiations, focusing solely on it might overlook other more substantial opportunities for savings. Embrace broader strategies such as shopping around or tweaking coverage details for genuine cost-effective insurance. What follows will challenge preconceptions and open your eyes to smarter discounts that go beyond mere bonus myths. Curious to learn about a rarely discussed facet of claiming processes? Read on…