Compare Car Insurance Policies: Find The Best Deals In 2025

How Weather Affects Your Premiums

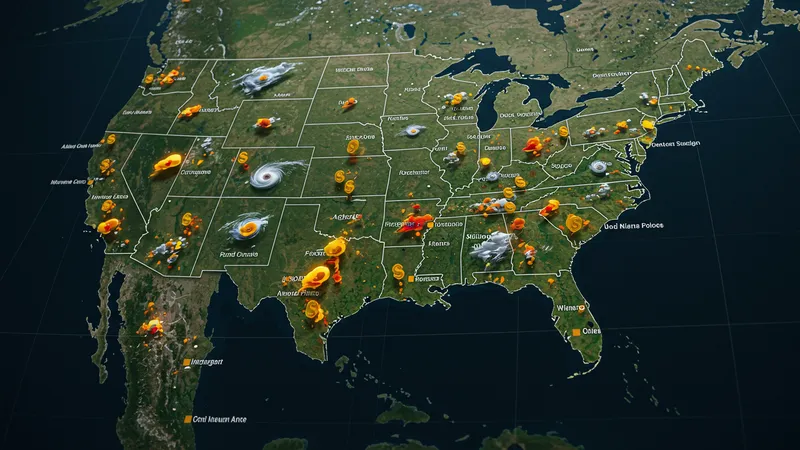

While it’s no secret that geography influences insurance rates, the specific impacts of local weather conditions often remain an underappreciated factor. Whether it’s the hurricane-prone coasts or tornado alleys, the frequency and severity of local weather events substantially affect insurance pricing, driving up costs in areas with frequent catastrophic events.

Insurance providers analyze historical weather data, incorporating it into complex models to assess potential risks for specific regions. A rise in claims from storm-related damages informs these patterns, motivating higher premiums in more volatile climates. This approach reflects a need for insurance providers to balance risk management against client affordability. But what if weather patterns change?

Climate change adds a complex layer to this calculus, as communities wrestle with shifting weather norms. Insurance models may adapt by implementing predictive analytics to capture new trends, increasing resilience in high-risk areas. Striking this balance demands innovation in both local adaptation measures and broad-scale industry reformations.

Drivers can mitigate these costs by creating personalized plans, investing in weather-resilient infrastructure, and seeking coverage tailored to their specific regional needs. As the impact of climate volatility realizes full scale, embracing preventative measures and policy flexibility is paramount for sustainable and affordable car insurance solutions. But what long-term changes lie ahead for these models?