Navigating The Quagmire Of Student Loans: A Comprehensive Analysis

An Unexpected Casualty: America’s Economy

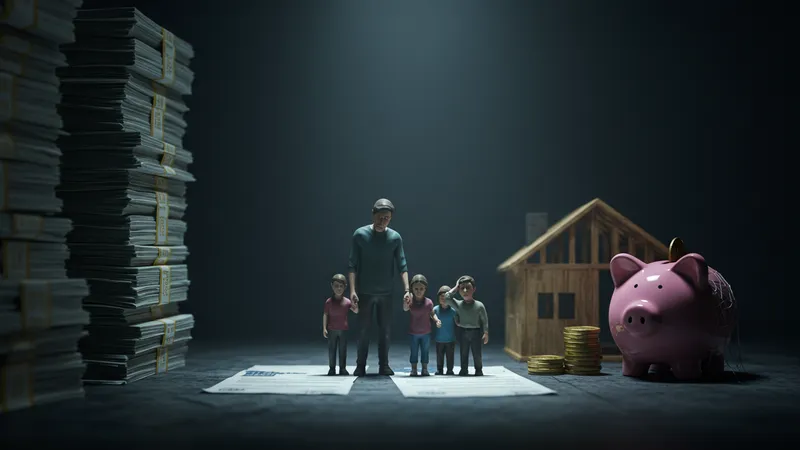

The staggering $1.6 trillion student loan burden reverberates within the overarching economy. With borrowing costs eroding disposable income, many graduates hold back on investing, spending, and contributing to economic growth. These unseen economic ripples pose the critical question: could eliminating or reducing this debt charge the economy forward?

Recent studies reveal how significant loan burdens prevent home ownership, delay retirement savings, and stagnate consumer spending. As these economic activities halt, potential GDP growth prospects also diminish. Can a strategic intervention in student loans herald a newfound economic optimism?

Critics argue that debt cancellation will burden taxpayers and inflate national deficits. However, a nuanced analysis reveals how unlocking trapped capital within the younger demographic could spur innovation, entrepreneurship, and revitalization. The scale of economic recovery linked to tackling the debt crisis is immense.

By addressing the student debt debacle, we wouldn’t just alter individual financial futures but could realign economic pathways nationwide. Whether these economic scenarios turn into reality hinges on a blend of policy shifts, systemic reforms, and national determination. Will bold steps echo forward into real change?