Online Tax Filing: Safe, Easy, And Refund-Friendly

Overcoming The Fear of Transitioning

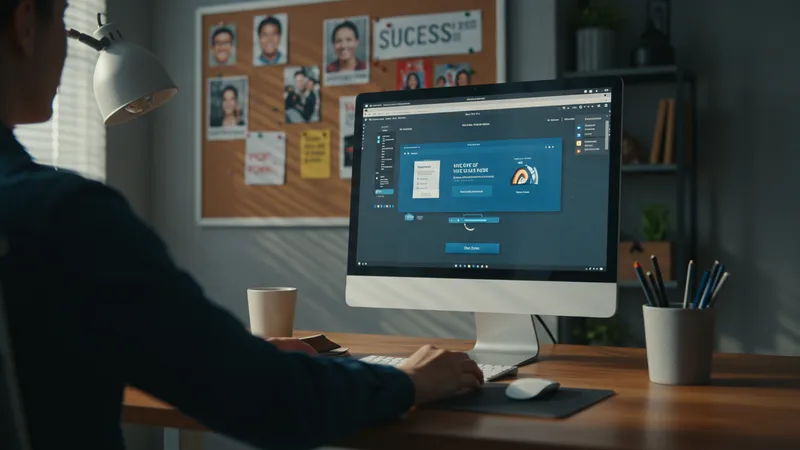

For many, the sheer thought of transitioning to online filing stirs anxiety. Concerns around data transfer, technological know-how, and reliability seem daunting. But the transition is far simpler than perceived. Streamlined guidance services take the risk out of the unknown. But there’s one more twist…

Narratives showcasing real-life success stories highlight how individuals and businesses thrived after making the switch. These stories dispel myths of technological hurdles and feature practical tips from those who’ve successfully navigated the change. What you read next might change how you see this forever.

The flexibility of online systems empowers users to embrace changes at their own pace. Asynchronous learning resources and trial runs grant individuals the opportunity to familiarize themselves without falling behind on obligations. This gradual approach catalyzes complete comfort with the new method. But there’s one more twist…

Online communities thrive around these platforms, offering new users a network of support and friendship, where questions are welcomed, and answers abound. Being part of such communities reduces apprehension significantly, demonstrating that even the newest users aren’t alone in the transition. What you read next might change how you see this forever.