What You Should Know About Large Life Insurance Policies In Egypt Vs. The USA

Comparing Costs: A Surprising Revelation

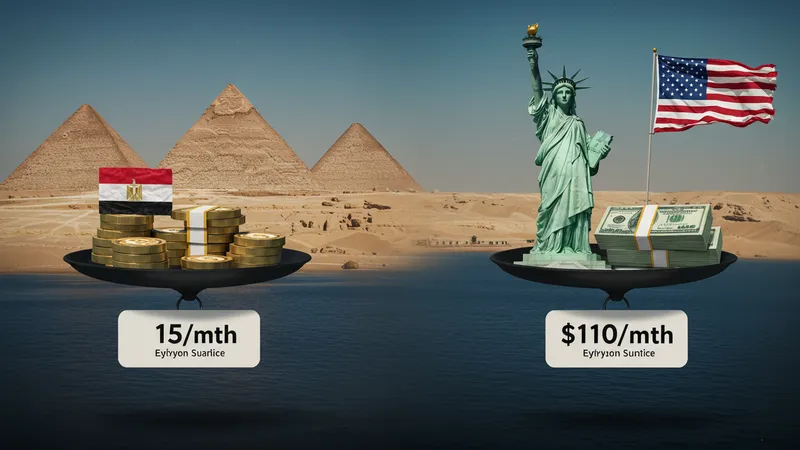

One striking revelation when comparing life insurance policies is the vast cost difference. While Egypt offers policies as low as $15/month, the USA’s can skyrocket to upwards of $100/month for similar coverage. This gap isn’t just a financial curiosity—it’s driving a new wave of global insurance buyers.

The reasons behind these pricing contrasts are myriad. They include differences in living costs, government subsidies, and the competitive landscape of each country’s insurance market. However, there’s more beneath the surface. What’s hidden away is how policies are packaged, often including unexpected add-ons.

While Egyptian policies might initially seem enticingly cheaper, they often incorporate investment components meant to enhance value over time. This dual-purpose strategy, though clever, can sometimes introduce complexity and risk. But that’s not all you need to know…

In the U.S., transparency rules the day. Policies are straightforward but come with premiums for peace of mind. The sales approach stresses clarity and security, crucial in a market driven by consumer protections. Yet, this assurance comes at a price. What lies beyond is even more complex than expected.