Why Health Insurance Is A Must—Even If You’re Young And Healthy

Emergency Medical Coverage Plans for Young, Healthy Adults

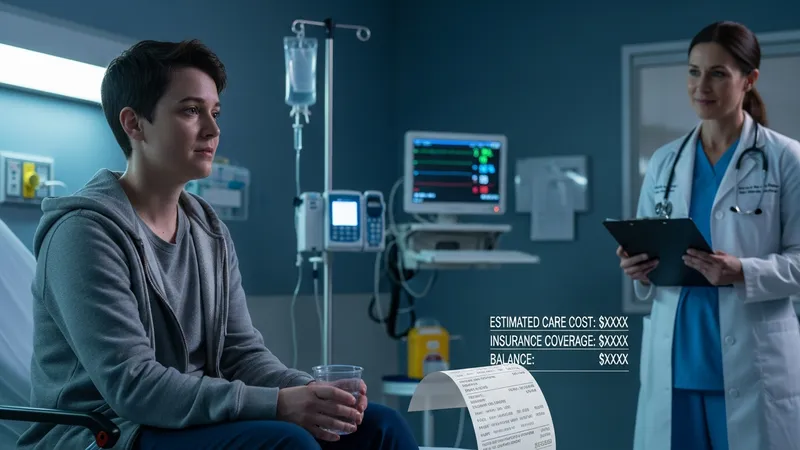

Emergency medical coverage plans are structured to support individuals in the event of unforeseen health problems, particularly those that require urgent attention. For those who are young and in good health, the risk of a major health event may feel remote, but data generally indicates that accidental injuries and sudden illnesses can occur unpredictably. These coverage options usually focus on hospital stays, ambulance services, emergency room care, and select follow-up treatments suffered as a result of emergencies.

One distinguishing feature of emergency-focused insurance is the limited scope of benefits, which typically does not include routine or recurring care. Policyholders may notice lower monthly costs in exchange for higher deductibles and out-of-pocket limits, resulting in a plan that responds primarily to high-impact, low-frequency events. This model may align with the low anticipated usage of medical services commonly seen among younger, healthier populations.

It is relevant to note that, while emergency medical coverage helps address the immediate financial risk from accidents or acute health incidents, it generally does not extend to preventive services, mental health care, or ongoing medication needs. For those interested primarily in safeguarding against catastrophic expenses rather than covering everyday health requirements, this structure provides a defined and targeted approach.

Numerous global studies suggest that access to emergency insurance coverage has been linked to reduced instances of medical debt when emergencies do occur. Having this form of coverage can often be a crucial factor in ensuring a single unexpected health event does not result in significant long-term financial disruption or debt accumulation. Subsequent sections will explore other forms of coverage relevant to young and healthy adults.