Why Health Insurance Is A Must—Even If You’re Young And Healthy

Catastrophic Health Insurance: Financial Protection for Major Events

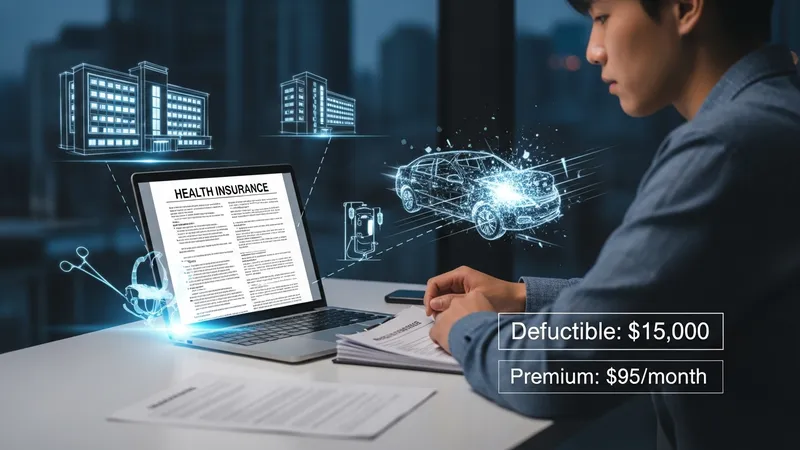

Catastrophic health insurance models are engineered to serve as a financial safety net against rare, high-cost medical scenarios such as serious accidents, major surgeries, or hospitalizations. These plans often appeal to young, healthy persons who do not expect to need regular medical care but who wish to limit financial exposure in case of severe health emergencies. The core structure typically features low monthly payments offset by high deductibles before coverage applies.

Eligibility for catastrophic plans is often tied to age or certain specified life circumstances, and enrollment criteria differ across markets. The limited routine benefits mean policyholders are responsible for basic and preventive care, but the insurance activates after crossing a significant expenditure threshold due to eligible major events. This approach reflects a focus on financial risk management rather than comprehensive service access.

Catastrophic plans may also include access to certain essential health benefits once the deductible is met. Policy documentation usually outlines exact coverage limits, benefit exclusions, and claims process in clear terms. For individuals whose primary risk is low-frequency, high-impact medical events, these plans may offer a feasible way to handle those scenarios with a measure of financial predictability.

It should be noted that catastrophic health coverage is not a substitute for regular health maintenance or ongoing care. Its design purpose is to prevent a single serious medical issue from causing prolonged financial instability. The subsequent section will address broader implications, including overall accessibility and healthcare resources for young, healthy individuals with insurance.